Wednesday September 7, 2016

One of the many unanswered questions regarding the impending 0.50 percent global sulfur cap – be that in 2020 or 2025 – is what will happen to all the fuel oil currently being used by marine?

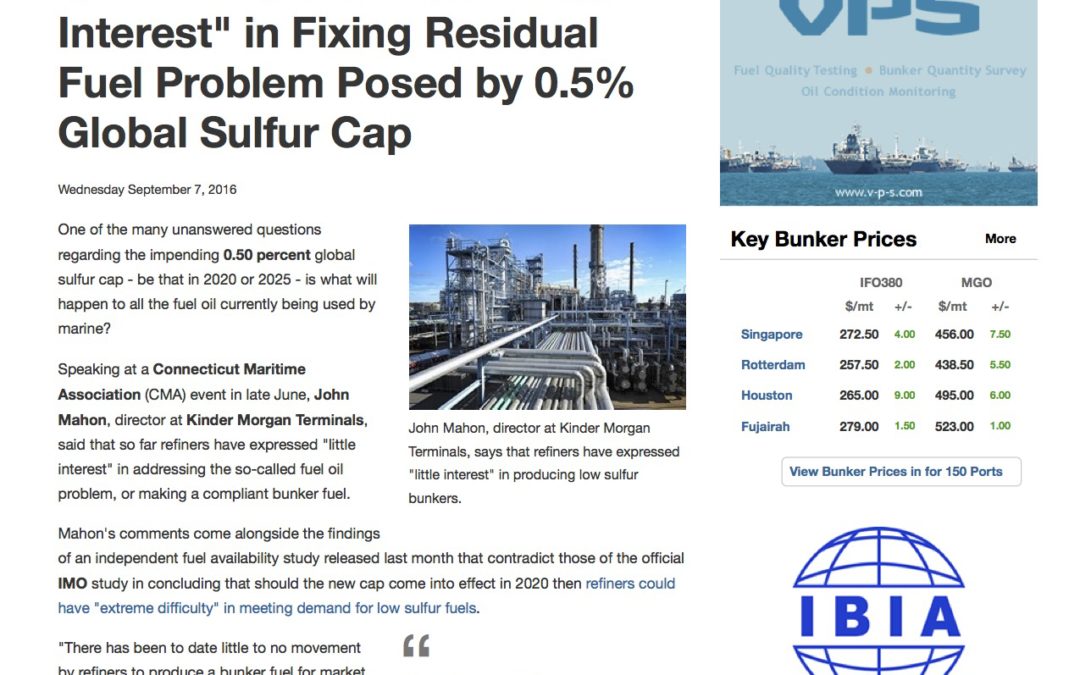

Speaking at a Connecticut Maritime Association (CMA) event in late June, John Mahon, director at Kinder Morgan Terminals, said that so far refiners have expressed “little interest” in addressing the so-called fuel oil problem, or making a compliant bunker fuel.

Mahon’s comments come alongside the findings of an independent fuel availability study released last month that contradict those of the official IMO study in concluding that should the new cap come into effect in 2020 then refiners could have “extreme difficulty” in meeting demand for low sulfur fuels.

“There has been to date little to no movement by refiners to produce a bunker fuel for market. To fix that you are going to have to build massive investment at the refinery level to desulfurise,” he said.

“If you are going to spend money desulfurising, you’re going to choose to upgrade the barrel to something other than resid.

“There is very little interest in the refining community that I’ve seen in fixing the resid problem. If they are going to fix the problem they’re going to make a lot more diesel and distillate, which has a lot more value to them.”

But even left unaddressed, a demand case for otherwise non-compliant fuel oil should still exist, not least of which stems from the cost of burning only distillates.

The Cost of Using Distillates

Marine and Energy Consulting Limited‘s Robin Meech has previously predicted there will be a 75 / 25 percent split between HFO and distillates in 2019.

Using a figure of 300 million tonnes for annual bunker sales, at today’s prices Ship & Bunker data indicates the global bunker bill is around $95 billion – HFO being around $260/mt and MG0 $480/mt.

That annual bill would increase by $50 billion, around 50 percent, to $145 billion if only distillates were bought and burned.

While that is a sizeable increase, it isn’t clear how big that number needs to be before owners feel it makes sense to invest in scrubbing technology so vessels can still use HFO.

Whether or not it would even be possible to fit a meaningful number of vessels with scrubbers has also been debated, and for the record, earlier this year the Exhaust Gas Cleaning Systems Association (EGCSA) said it has “ample scrubber capacity for 2020” and is ready to help shipping comply with a 0.50 percentglobal cap,.

That said, Mahon is among those who note that to date scrubber uptake has been limited.

“I have not, in my conversations, heard shipowners say a lot about scrubber technology other than ‘we’re looking into it’,” he said.

“As long as oil prices are low, gas oil looks pretty good compared to high bunker prices we paid just three years ago. But if you see oil go back up, and the differences between the two move, it will be a very expensive issue for shipowners.”

Another path for the continued use of fuel oil that has not yet received widespread attention is as part of 0.50 percent maximum sulfur residual / gasoil blends.

In June Adrian Tolson, Senior Partner, 20|20 Marine Energy, told Ship & Bunker he expects most suppliers to produce such a product.

“There are lots of options, and depending on the location they could include Vacuum Gas Oils(VGOs), or topped low sulfur crudes,” he said.

In June, Ship & Bunker reported that the official study undertaken on behalf of the International Maritime Organization (IMO) had found that there are no major barriers to producing enough compliant bunkers to meet a 0.50 percent global sulfur cap in 2020.