Genoil is building a new international global network to develop ten million barrels per day of new oil production from conventional reserves that is profitable at today’s low oil prices. The company is a provider of world leading hydroconversion fixed bed technology for upstream and downstream oil and gas industry. The company is also working with a top Chinese policy bank and Chinese companies to provide, project financing, drilling, production, and processing services to the oil and gas industry. Through these partnerships and strong financial backing, Genoil can supply the oil industry with a full range of products and services, from exploration through production, solutions for hydrocarbon development and recovery, upgrading and environmental protections services. Complemented by partners who have many years of operational experience we can provide a wide range of process technologies at unparalleled value to our customers.

Market Scope Overview

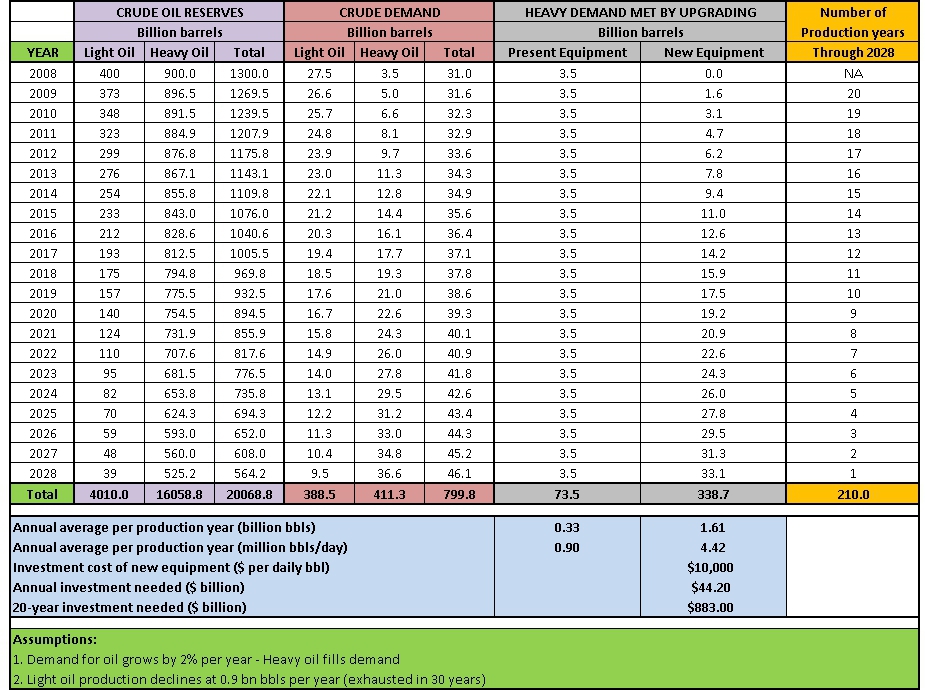

There are 900 billion proven barrels of heavy and medium crude oil in the world. The scope of the opportunity is Genoil can convert these 900 billion barrels creating an average increased incremental value of $50.00 per barrel based on an average Brent Crude pricing of $100 over the next 20 years. Genoil has the capability of unlocking $45 trillion dollars over this period. Heavy oil spreads even during the current period of 2015-2016 are quite large at over $20.00 per barrel. Genoil successfully tested its hydroconversion upgrader on bitumen feedstock as low as 6.5 API.

We consider Genoil a Kleiner Perkins or Google scope of opportunity as these profits are quite significant.

- Peak Oil has resulted in one of the greatest shifts in energy where light oil reserves used to be adequate to supply world demand. This is no longer the case and more and more heavy or sour oil production is coming online – $45 trillion total market scope..

- Environmental fuel legislation and stricter sulfur requirements are increasing demand for hydroconversion units globally.

- Low cash requirements.

- Strong strategic relationships -$ 5 billion LOI from major Chinese lending institution.

- Genoil GHU technology is unmatched.

Revenue Generation

Due to industry standard lead time requirements related to Genoil’s GHU technology for feedstock testing, front end engineering & design (FEED), construction lead times and equipment and implementation costs, Genoil has developed and delineated several possible methods of revenue generation within each contract or project. Each project contract is negotiated based on the flow level (barrels per day) required to fill the client’s need beginning with the capacity requirements for the applicable GHU’s. The following is a brief description of each of the four revenue streams possible for each Genoil GHU contract:

- ECM Revenue – (Engineering and Consulting) – The ECM revenue involves the upfront/basic engineering, project design, procurement and implementation for upstream and downstream projects. These revenues are typically calculated at between 15% and 20% of the total project costs.

- Licensing Fee / Royalties – This is a long-term licensing agreement where the fees are based on the profitability of the Genoil process where Genoil will capture 15% of the profit from each flowing barrel per day.

- Profit Share – Income generated from Genoil’s ongoing participation and ownership of a project in the case of Zhongjie Petrochemical and Genoil’s Joint Venture, Genoil will own 70% of the project.

It is anticipated that the typical contract for Genoil would involve ECM and royalty revenues. Both of these revenue streams would typically be collected within a twelve-month time frame from the point of contract. There may be instances where Genoil invests capital into a project and remains as a partner. At that point, Genoil would typically receive royalty revenue of 15% of all profit generated based on the difference between the price of the feedstock and the price of the processed product. Based on today’s prices of heavy crude feedstock and the sale price of the processed product, the net effect of the royalty revenue would be no less than $3 per barrel processed.

Below is a descriptive list of Genoil contracts in existence or in negotiations as of year-end 2016:

Zhongjie Petrochemical Project – Genoil has a $700 million joint venture contract with Zhongjie Petrochemical Corporation who is one of China’s largest energy producers to place a 20,000 bpd GHU unit in the Hebei province of China. The new refinery will incorporate the GHU technology and will be located adjacent to the existing petrochemical facility. The new refinery will process a variety of crude feedstock. Genoil will provide the process engineering, detailed engineering, fabrication and construction services for the project working with an engineering company in China. Genoil is required to raise 70% of the total contract price into the project, an approximate $500 million. Once operational the project will have a ROE of 31% and a payback period of 8.16 years.

Arabian Medium Crude Oil Project – Genoil is working to close a contract for the construction of a 500,000 bopd GHU facility with a total estimated project cost of $5 billion. Genoil is in negotiations to secure a royalty of 15% or a minimum of $3.00 / barrel. The licensing or royalty would be based on a 500,000 per daily barrel capacity or $ 540 million dollars / year.

North American Heavy Crude Oil Project – Genoil is working to close a deal in South America. The project will begin with 100,000 – 250,000 bpd of production. Genoil is organizing a consortium that will provide other services such as drilling 20 offshore wells, one pipeline, and offshore pumps to the client. Genoil is to leading this consortium, which is capable of providing all required services to the client.

Ship Fuel Oil Desulfurization Plant – Genoil is negotiating with several shipping lines to build in excess of 16 million tons / year (320,000 bpd) of High Sulfur Fuel Oil (HSFO) with 3.5%. The Chinese bank and engineering firm would lend all the money for the plant and provide necessary project guarantees. The estimated project cost is $3.2 billion that would be incurred over a three-year period. Genoil estimates it would earn a daily license fee of $3.50 / bbl. Based on this Genoil would generate approximately $1,120,000 million per day or $403,000,000 per year. Genoil believes that once it completes the contract for these 16 million tons / year that we can double our sales for the following year and double it again for the year 2019. We think that this doubling trend could continue on an annual basis.

Other GHU Projects – It is our goal to build 500,000 bpd of upgrading capacity annually. This estimate is based on recent conversations with prospective clients who are national oil companies. Each project would have an estimated licensing fee income of 15 % of the total profit or a minimum of $ 3.00 per barrel. The company would also generate significant revenues for engineering services amounting to 20% of the total project costs. Project costs are estimated at $8,000 usd per barrel of capacity with the smallest GHU being 20,000 barrels per day or $160 million.

Global Crude Oil Reserve Analysis

Crude petroleum is the largest single source of energy in the world, accounting for approximately 3540% of energy consumed in the world, and is the basic building block for a large number of chemical products consumed globally. In early 2010, global crude petroleum demand was slowly recovering after the first decline in growth since the early 1980’s. Demand growth in the US, Japan, and Western Europe will be slow as domestic economies start to improve. In regions such as South and Central America, Africa, Middle East, and Eastern Europe where domestic demand is slowly on the rise, growth will be more robust as markets give way to exports. Asia continues to experience the greatest demand growth and a focus on domestic development. World oil demand is forecast to increase steadily 1-2% through 2011 and rise to 2% for 2012-2014.

As of January 1, 2010, the estimated world proved reserves of crude petroleum were 1.2 billion barrels. OPEC currently accounts for 71% of total world oil reserves. Saudi Arabia holds the single largest share of the world’s petroleum reserves at 19% of the total. On a regional basis, the Middle East accounts for nearly 56% of the world’s reserves. North America is second with 15%, and Central and South America is third with 9%, following recent reserves identified in Brazil and Venezuela.

The International Energy Agency (IEA) estimates that 70% of the worlds remaining oil reserves consist of heavy, high sulfur sour crude. Oil companies must either seek new sources of lighter, easier to extract and refine, crude oil or find new methodologies to utilize the worlds existing heavy oil reserves. Since the cost for exploration, production and processing continues to climb, the focus should be on the maximum utilization of known reserves by recovering more of the original oil-in-place (OOIP) and producing more usable consumer products during refining. The average sulfur content of U.S. Crude oil imports increased from 0.9% in 1985 to 1.4% in 2005, and the slate of imports is expected to continue to sour in coming years. Crude oils are also becoming heavier and more corrosive than they were in the past, largely because fields with higher quality varieties were the first to be developed, and refiners preference for quality crude oil has led to the depletion of those reserves over the past 100 years reducing the market share of light, sweet crude that remains.

Published reports indicated that at year-end 2007 there were 650 major refineries located around the world. These refineries process a total of 85 million barrels of oil per day. As the sources of premium light-sweet crude oil are depleted, OPEC and other global oil producers will be forced to use increasing amounts of existing heavy-sour crude oil to supply world demand. Not only will additional refining capacity be required to process the increase supply of crude oil, but refineries will need to be designed to process heavier, lower quality crude oil in order to yield the same amount of transportation fuel. For example, premium crude oils yield almost 70% of their volume as light, high-value products (gasoline, diesel, jet fuel, kerosene), whereas heavier crude oils yield only about 50% of their volume as light products. So in order to produce the same amount of refined product from heavy, sour feedstock, a refinery has to have 1.4 times as much capacity (70 divided by 50). There would need to be 182 refineries built (52 more) in order to supply the world with the equivalent amount of transportation fuel in 2017.

As of January 1, 2010, the US had a reserve to production ratio of approximately ten years, while Russia had a reserve production ratio of seventeen years. Opec nations have a reserve ratio of 92 years while oil producing nations in the Middle East has an average of over 100 years.

__________________________________________________

Disclosure

Much of the information included in this Business Outline and related Financial Summary section includes or is based upon estimates, projections or other “forward looking statements.” Such forward-looking statements include any projections or estimates made by Genoil and its management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Such estimates, projections or other “forward-looking statements” involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other “forward–looking statements“. We are an early stage development company, which is primarily involved in providing new technology products to the global oil and gas industry. We do not have a historical record of sales and revenues nor an established business track record from the operation of our business.Given our limited operating history, there can be no assurance that we will be able to achieve our goals and develop a self-sustaining business model. Management intends to raise capital as needed to finance the operating and capital requirements of our company. In addition, management expects cash flow from operations to increase over the next year. It is the intention of the management team to move forward with the business plan of the Company in order to drive revenue-producing activities. These factors raise substantial doubt about our ability to continue as a going concern. The future of our company will depend upon our ability to obtain adequate financing and continuing support from stockholders and creditors and to achieve and maintain profitable operations. To the extent that we cannot achieve our plans and generate revenues, which exceed expenses on a consistent basis and in a timely manner, our business, results of operations, financial condition and prospects would be materially adversely affected. As we proceed with the development of our business plan, we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle marketing efforts and perform finance and accounting functions. We will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.